estate tax changes in reconciliation bill

2021 Reconciliation Bill. Uncertainty makes tax and estate planning more challenging.

Opinion Truth And Reconciliation Is No Walk On The Beach Prince George Citizen

In addition the proposed bill.

. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be approximately 6 million. While the IRA contains far fewer tax changes than previously proposed legislation key tax changes were retained. Families making up to 150000 can also get a 4000 tax credit for used electric vehicles.

The result of the change is an effective rate of 159 50 of 25 38 if the taxpayer is not subject to the 3 surtax on individuals with adjusted gross income over 5 million as discussed above or 174 50 of 25 38 3 if the taxpayer is subject to the surtax. Many of the key tax benefits currently associated with the utilization of grantor trusts will no longer be available if the House proposal is passed in its current form. Congress completes reconciliation bill with key tax changes.

The House passed the Inflation Reduction Act of 2022 IRA which is expected to be signed by President Biden in the coming days. In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill. Cut in half the basic exclusion amount reducing the estate gift and GST tax exemptions from 11700000 to approximately.

And even though the legislation is still subject to change there are proposed provisions that. If the bill passes impacted IRA owners will have two years to make the change or face full taxation of all assets in the IRA. A 1 surcharge on corporate stock buybacks.

107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. The draft legislation was expected to be included in a larger budget reconciliation bill but as of. And for those making over 400000 An expansion of the net investment income tax and.

5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for estate planning. Corporate minimum tax. Revised Build Back Better Bill Excludes Major Estate Tax Proposals.

Estate planning changes dropped from US budget reconciliation Bill. Estate and gift tax exemption. The reconciliation bill would invest more than 400 billion over 10 years to be fully paid for by closing tax loopholes on the richest Americans and corporations the senators said.

The top marginal rate income tax rate would increase from 37 to 396 for individuals trusts and estates. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000 per person for transfers occurring after December 31 2021. The top income tax rate for long-term capital gains would increase from 20 to 25.

The tax credit applies for new vans SUVs and pickups up to 80000. The House budget reconciliation bill HR. The exemption will increase with inflation to approximately 12060000 per person in 2022.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. As the budget reconciliation bill goes up for a final Senate vote real estate partnerships should be evaluating how to adjust to the potential tax changes.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million. 313 billion The legislation would impose a 15 minimum tax on the book income of corporations.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. The expiration of the current laws estate tax exemption 24 million for married taxpayers would be accelerated by the House billcurrently it. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

With the 2022 Fiscal Year Federal Budget deadline of October 1 st rapidly approaching House Democrats presented a preliminary tax proposal targeting high earners wealthy estates and corporations to fund Bidens proposed 35 trillion infrastructure spending package. The clock would start after Dec. A 15 minimum tax on corporations.

For other cars the limit is 55000. If enacted the Bill would among other things. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget Reconciliation Bills provisions.

The reconciliation bill is not yet complete and we dont know what tax changes of Bidens American Families Plan will survive. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Any tax proposal will likely be pushed into a reconciliation bill which will only require a 51-50 vote in the Senate that would be 50-50 tie.

The whole bill should go down and for many more reasons than the. A separate 15 minimum tax on corporate profits earned abroad. The bill includes about 17 trillion in gross revenue raisers composed of about 470 billion in corporate tax increases 530 billion in individual tax increases 148 billion net from additional IRS tax enforcement 340 billion from the drug pricing provisions and about 177 billion in net revenue from Ways Means items scored by the Joint Committee on Taxation.

Bill C 8 An Act To Amend The Citizenship Act Truth And Reconciliation Commission Of Canada S Call To Action Number 94

Aboriginal Truth And Reconciliation Poll Angus Reid Institute

How The Senate S Big Climate Bill Eliminates 4 Billion Tons Of Emissions

Chapter 7 Moving Forward Together On Reconciliation Budget 2022

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

Everything In The House Democrats Budget Bill The New York Times

Road To Reconciliation Rural Municipality Of St Clements

Chapter 7 Moving Forward Together On Reconciliation Budget 2022

Aboriginal Truth And Reconciliation Poll Angus Reid Institute

Us Corporations Talk Green But Are Helping Derail Major Climate Bill Climate Policy Climates Corporate

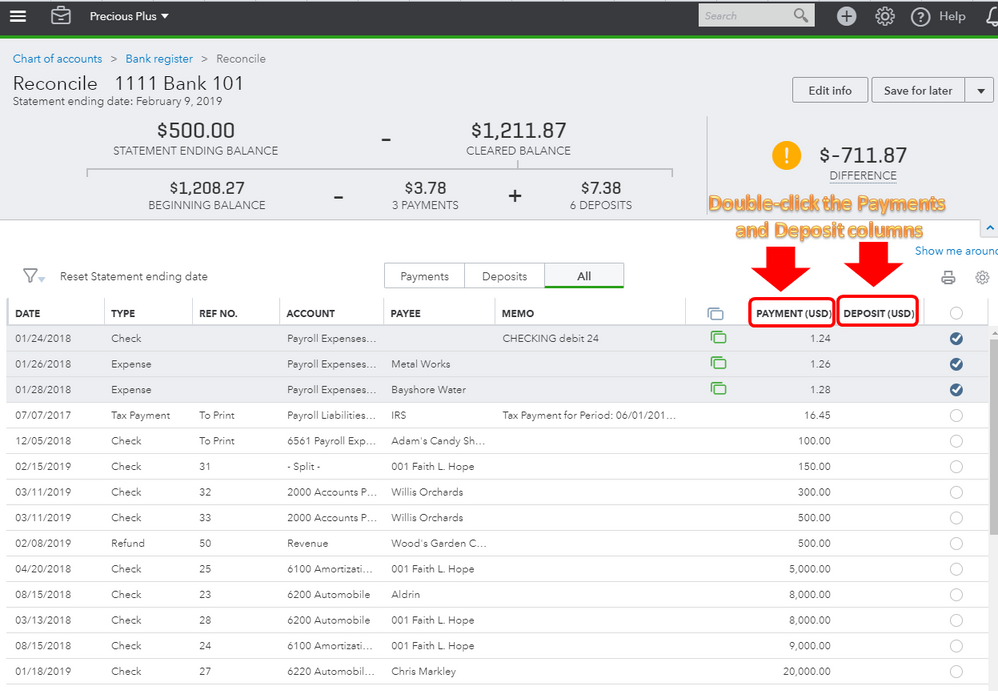

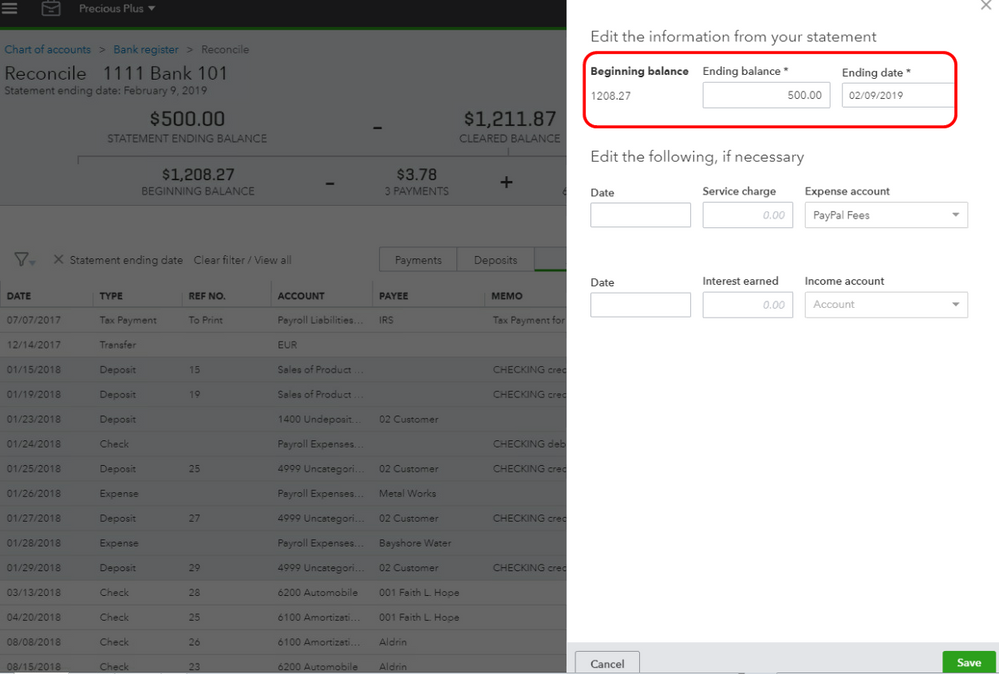

Solved Reconciliation Discrepancy

Five Tax Implications Of The Budget Reconciliation Bill For Retirees Wealth Management

Everything In The House Democrats Budget Bill The New York Times

Solved Reconciliation Discrepancy

Big Things In Democrats Budget Reconciliation Package E E News

/cloudfront-us-east-2.images.arcpublishing.com/reuters/F5X2GNUGCZJHNFNUSBWWUBSDZU.jpg)

Explainer U S Senate S Reconciliation Process It S Not The Way It Sounds Reuters

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else